In Q2, bank interest rates and GDP growth across Egypt, Nigeria, Morocco, Kenya, and Ghana have exhibited varying trends. In Egypt, high interest rates aimed at curbing inflation have posed challenges for borrowing and business expansion, though moderate GDP growth has been sustained by government investments in infrastructure and tourism. Nigeria has seen fluctuating interest rates due to economic instability and inflation concerns, leading to higher borrowing costs. While there are signs of economic recovery, GDP growth remains uneven, hindered by structural challenges and external pressures.

Morocco has maintained stable interest rates, fostering a steady economic environment with robust GDP growth driven by agriculture, tourism, and manufacturing. In Kenya, adjusted interest rates to manage inflation have supported strong GDP growth, bolstered by a dynamic service sector, infrastructure development, and private sector investment. Conversely, Ghana’s high interest rates, aimed at stabilizing the currency and controlling inflation, have led to increased borrowing costs, impacting investment and consumption. Despite moderate GDP growth, fiscal deficits and external debt pressures continue to challenge the economy.

July was the busiest month for venture capital activity this year so far, with funding for African startups surpassing the $1 billion mark. Driving the bulk of this amount was $176M securitization facility secured by Kenyan clean energy company d.light. The second major investment was Egypt’s MNT-Halan’s $157.5M funding round.

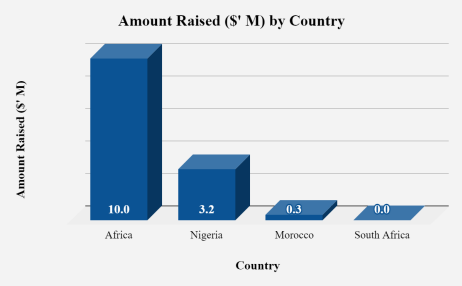

It is still a slow year for Nigeria, Ghana and Morocco. While the $1 billion point came earlier than expected, it is still lower and slower than in 2023, 2022 and 2021. By the end of June, African startups had raised $780M. Though Kenya raised the biggest chunk of this (32%), Egypt had the highest number of startups that secured funding.

Kenya led Africa in H1 2024 startup funding. Kenyan ventures secured $244M, accounting for 32% of the continent’s total start-up funding. They are followed by Nigeria with $172M, Egypt with $101M, and South Africa with $85M.

Egypt leads in VC raised in June and July, which amounts to $200.5M, followed by Kenya with 177.4M, Tanzania with $40M, Ghana with $33.3M, South Africa with $15.3M and Nigeria with $1.6M.

Fintech had the highest number of startups (6) receiving VC funding. However, Climatech slightly attracted a higher VC amount (176M) than fintech ($175.5M). Web3 received the least amount ($50,000)